|

|

09-23-2016, 09:57 AM

09-23-2016, 09:57 AM

|

#111

|

|

100,000 sperm and you were the fastest?

Join Date: Jun 2011

Location: In a house

Posts: 1,855

|

Jeeez! That's ridiculous.

I didn't get charged anything on my Mondo print, which didn't cost much more than you Fed-Ex bill.

|

|

|

09-23-2016, 11:53 AM

09-23-2016, 11:53 AM

|

#112

|

|

Kindly Asked To Leave

Join Date: Nov 2015

Posts: 879

|

Quote:

Originally Posted by SuperJ300

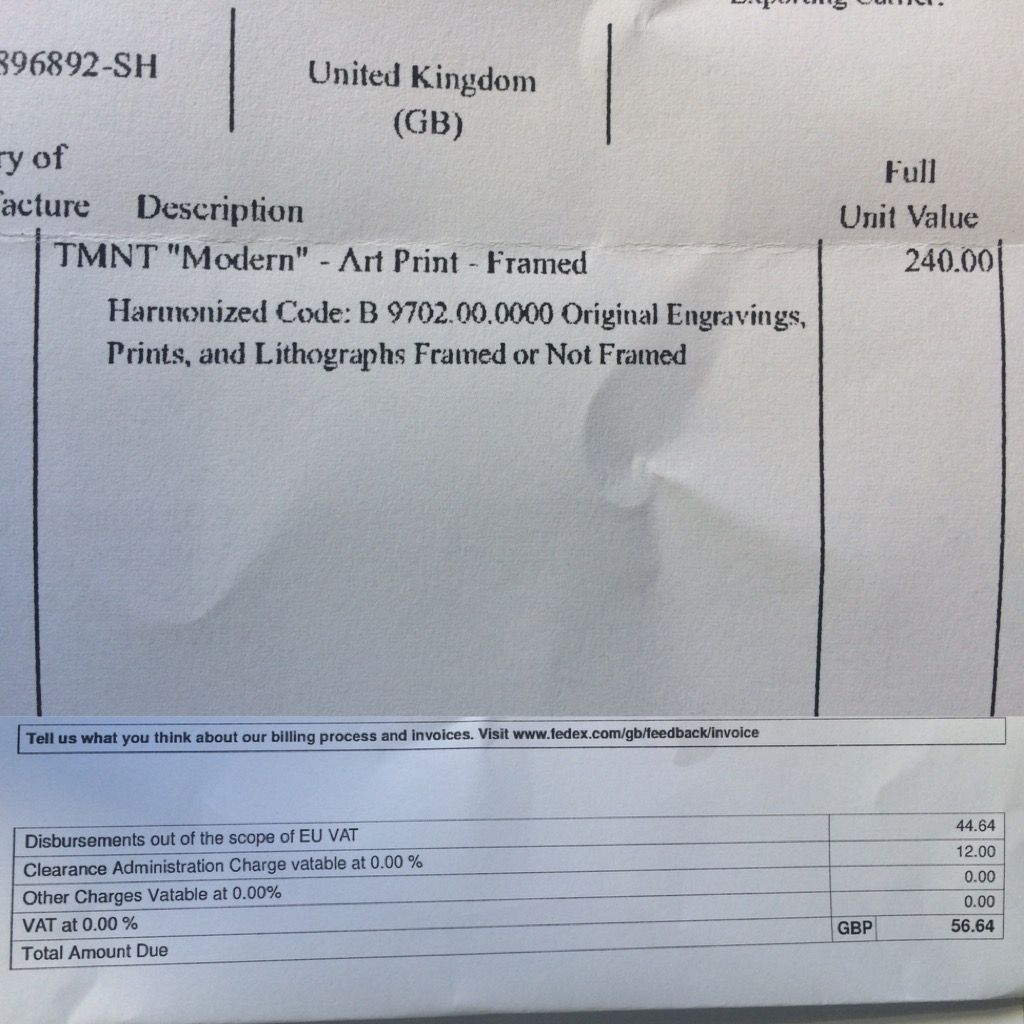

This is my FedEx bill for my art print!

£56 quid!!!!!

Is this right????

|

U know if u registered for a FedEx account number and instructed Sideshow to use that to clear your package with Customs, Fed Ex would probably waive that 12£ clearance fee

|

|

|

09-23-2016, 11:56 AM

09-23-2016, 11:56 AM

|

#113

|

|

Kindly Asked To Leave

Join Date: Nov 2015

Posts: 879

|

My FedEx account number is billed taxes directly here in Canada

With over 50 parcels imported over the years, its saved me $500 more or less...

|

|

|

09-23-2016, 11:58 AM

09-23-2016, 11:58 AM

|

#114

|

|

Have you ever imagined a world with no hypothetical situations?

Join Date: Mar 2011

Location: UK

Posts: 3,653

|

No, you have been charged 20 percent. It looks like it's not even the dollar value that was used but the pound value, depending on the cost of shipping which was probably a lot with the frame, but still looks like cat was charged at 20 percent.

They have put the right code on for prints though. So might be because it's framed because prints fall under 9702 for 5percent vat purposes.

Update: framed prints do fall inline with 9702, so should have been charged 5 percent. Not sideshows fault.

|

|

|

09-23-2016, 12:00 PM

09-23-2016, 12:00 PM

|

#115

|

|

Kindly Asked To Leave

Join Date: Nov 2015

Posts: 879

|

Customs also ----ed up the conversion...

20% on 185 £ is 37 ....

|

|

|

09-23-2016, 12:07 PM

09-23-2016, 12:07 PM

|

#116

|

|

Have you ever imagined a world with no hypothetical situations?

Join Date: Mar 2011

Location: UK

Posts: 3,653

|

Quote:

Originally Posted by dood

Customs also ----ed up the conversion...

20% on 185 £ is 37 ....

|

Plus shipping which he hasn't shown.

|

|

|

09-23-2016, 12:08 PM

09-23-2016, 12:08 PM

|

#117

|

|

Omega Red

Join Date: Dec 2008

Location: United Kingdom

Posts: 9,051

|

Yeah, that's wrong. And Dood is correct, create a Fed Ex account, send the details to Sideshow and the clearance fee will be waived. Your tax will also be paid straight away rather than having to wait for the invoice to be sent.

Also as a Side note for UK guys. If you get a Halifax Credit card (I think it was the clarity card but do check) currency conversions are free where as many banks charge around 3% or more. I got one just for buying from Sideshow.

|

|

|

09-23-2016, 12:09 PM

09-23-2016, 12:09 PM

|

#118

|

|

Kindly Asked To Leave

Join Date: Nov 2015

Posts: 879

|

I'm pretty sure when I pay my 5% GST on imports it's on the converted CDN / USD balance excluding shipping cost. I could be wrong...

|

|

|

09-23-2016, 12:12 PM

09-23-2016, 12:12 PM

|

#119

|

|

Have you ever imagined a world with no hypothetical situations?

Join Date: Mar 2011

Location: UK

Posts: 3,653

|

You could be wrong or right, who knows. This is in regards to a UK perspective though.

Should have been around 11.17 pounds for vat (plus the current 12 admin fed ex fee)

|

|

|

09-23-2016, 01:32 PM

09-23-2016, 01:32 PM

|

#120

|

|

Kindly Asked To Leave

Join Date: Nov 2015

Posts: 879

|

Confusing

OK

so I logged into my Fed Ex Account, and all invoices are now electronic.

The last shipment I was charged $27.97 DUTY / TARRIFF

The classification code used on the import was 6810.99.00.00 which is HS Code for concrete stone and materials, not statues made of any material.

The B3 header & commercial invoice information states Federal Express Canada Ltd. has completed this customs entry on (my) behalf. Please note that the importer of record (Importer) is ultimately responsible for the accuracy of the accounting information submitted to the CBSA and must report all errors and/or omissions to FedEx, in writing, within 10 days from receipt of the accounting information.

Well other imports use the correct 9703.00.00.00 HS Code, According to NAFTA there should be NO DUTY only GST.

Its frustrating because for my Gray Hulk EX the Value for Currency Conversion included an additional $70 in shipment costs which normally is not included in the Item Price.

Fed Ex keeps sending me over to CBSA or the merchant (Sideshow). Finally a supervisor escalated the case to their department. I'm assuming Fed Ex fills this information out? Correct?

|

|

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

All times are GMT -4. The time now is 06:20 PM.